In order to further research into how those pain points were taking place in young adults’ lives, I dived into finding out the following three findings. Based on my research, it is clear that learning to manage personal finance is a significant practice for young adults to become financially independent and have confidence in their finances.

In order to get further understanding of users’ needs and painpoints, I have conducted user interviews with 6 interviewees who met the target demograpihic. After doing the interviews, I was able to gain insights on common frustrations, goals, and behaviors that potential users would have and struggled with. Based on the findings, I came up with the following key insights which I grouped them to develop further in my design of the app as key components of controlling personal finance.

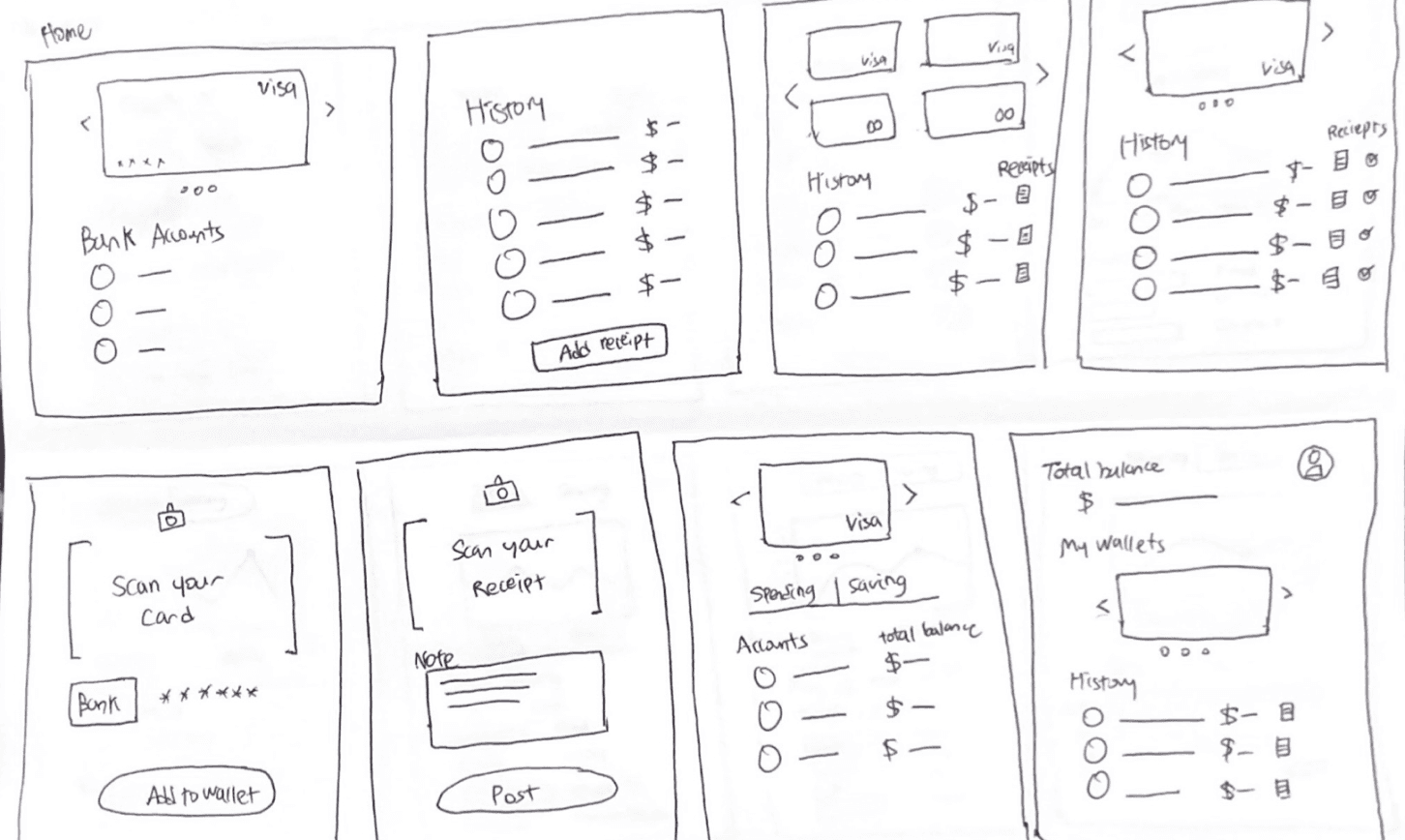

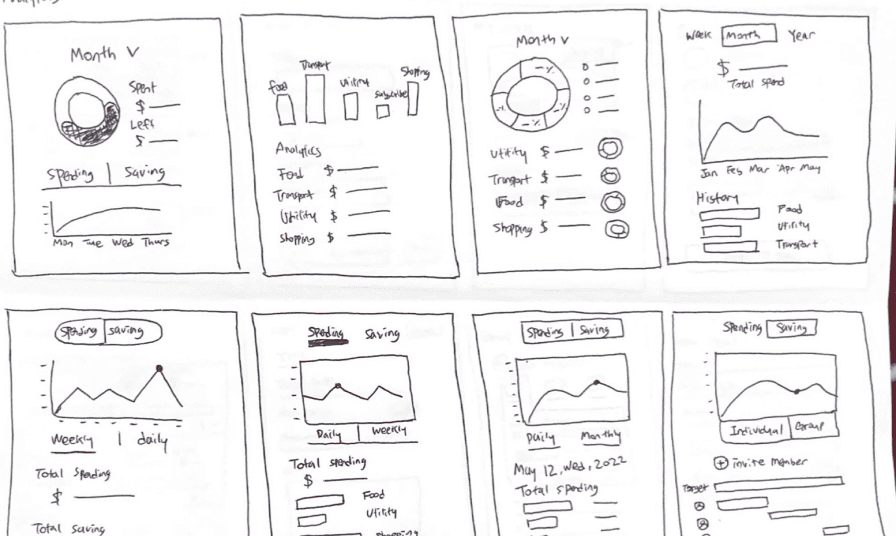

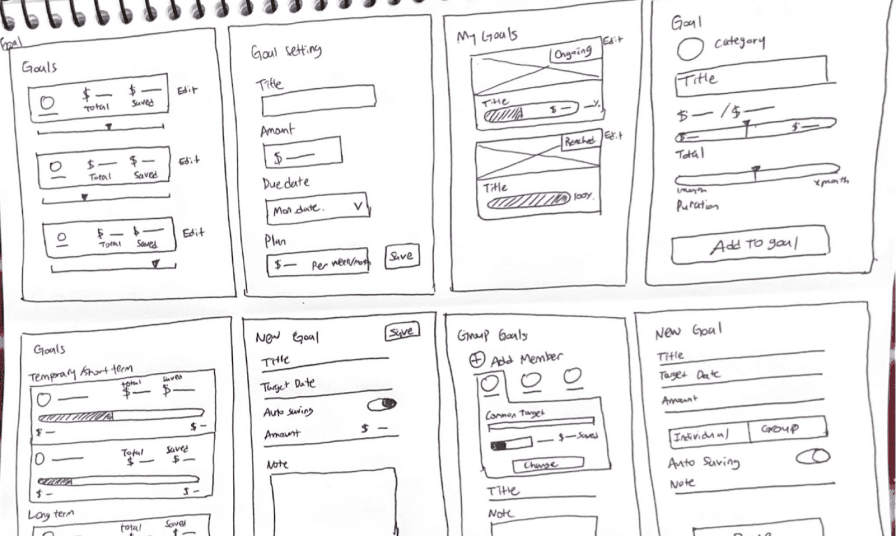

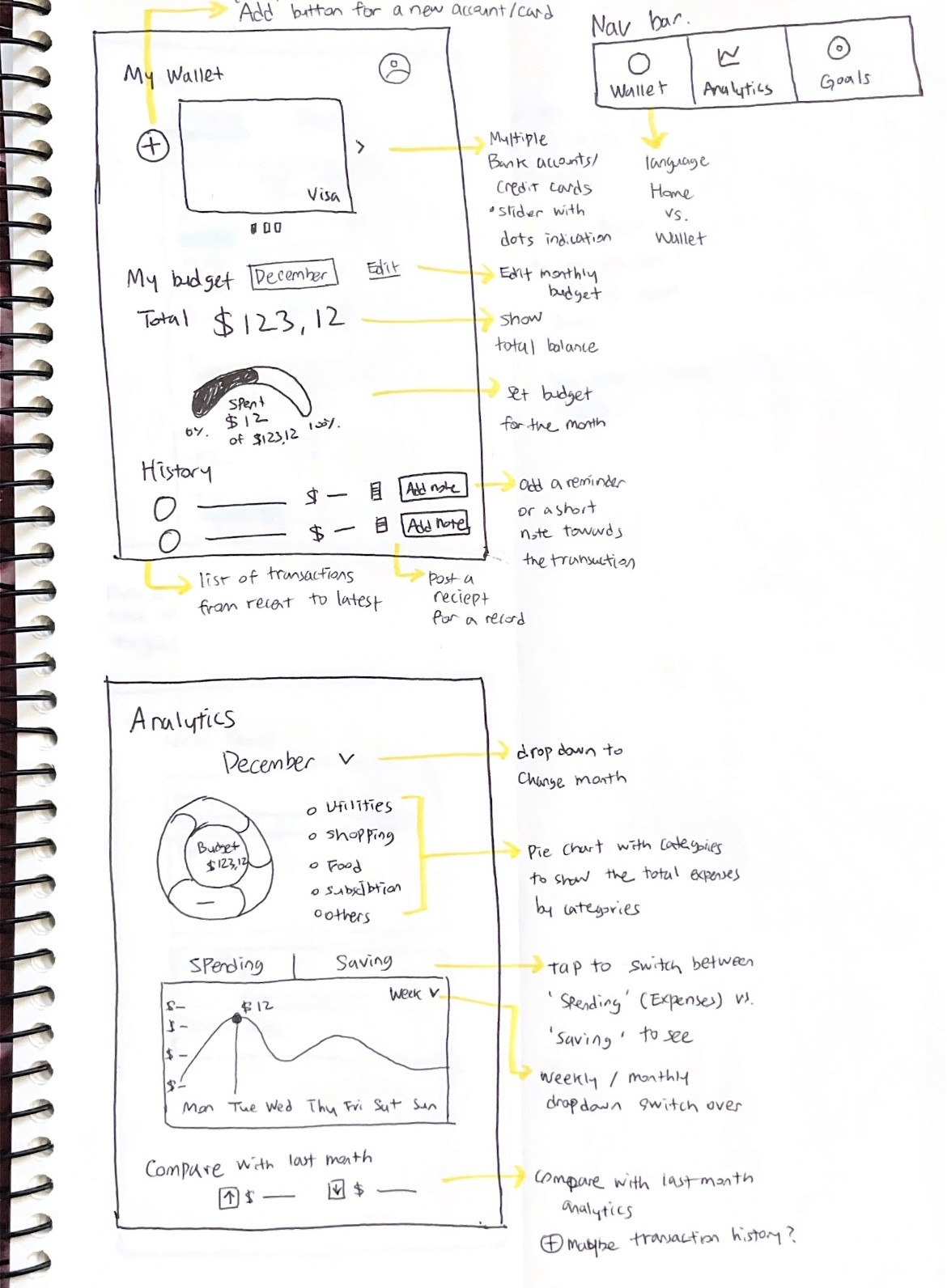

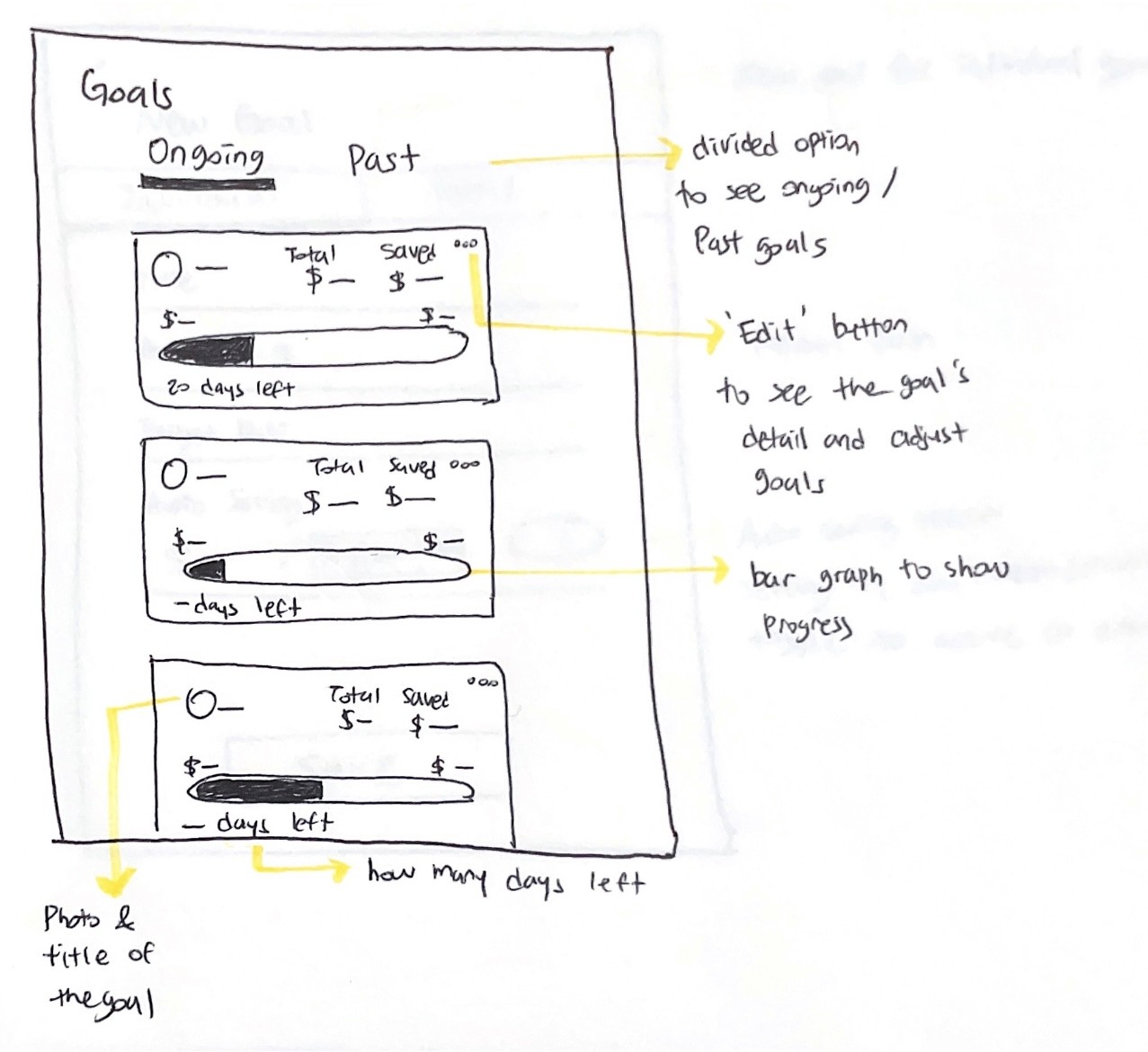

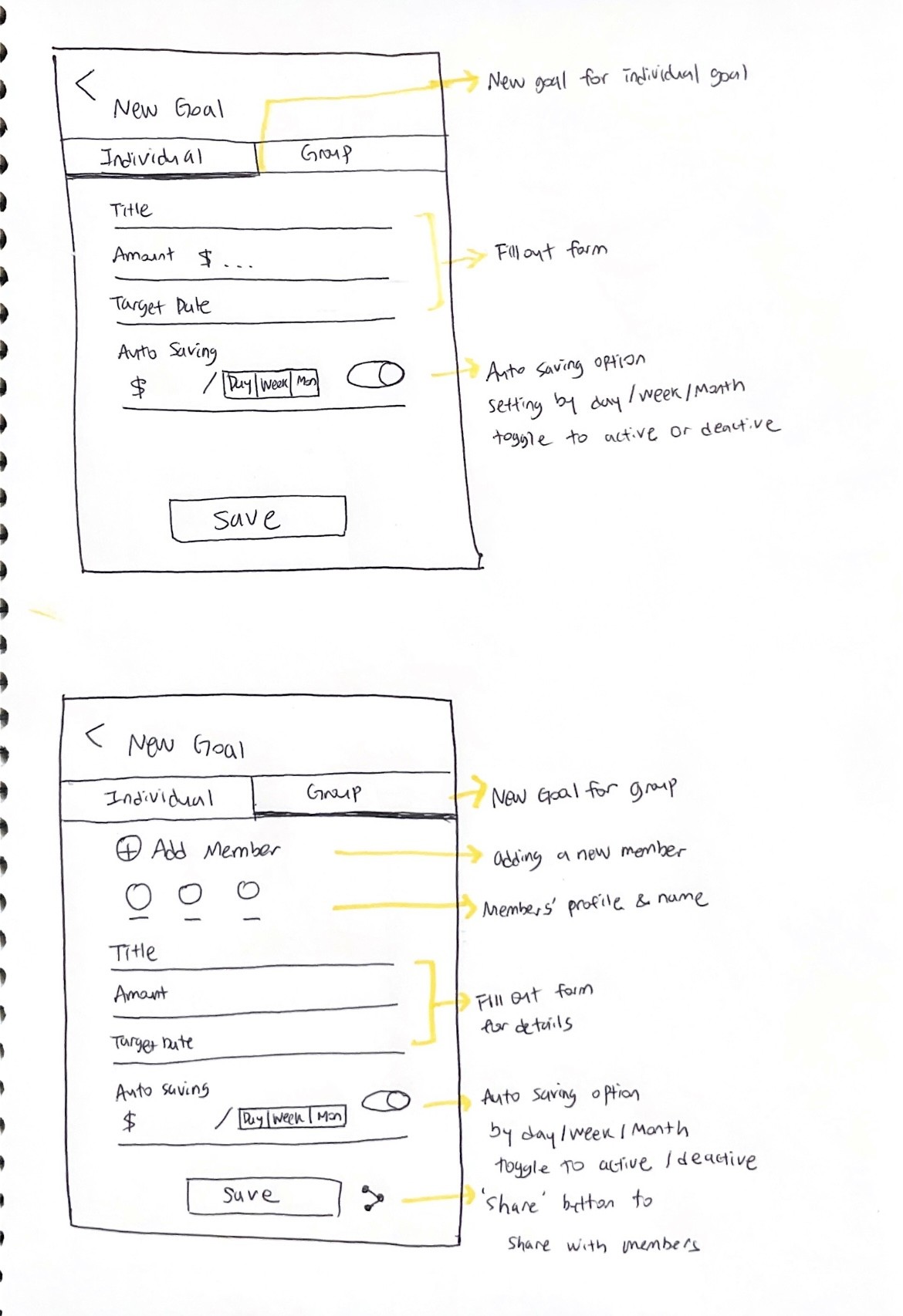

I proceeded with the ‘Crazy 8’s’ to go forward with pages and functions. After doing each sketch, I came up with a solution sketch by combining my best solution. By doing so, I was able to get a broader ideation and filter out to find feasible and innovative design.

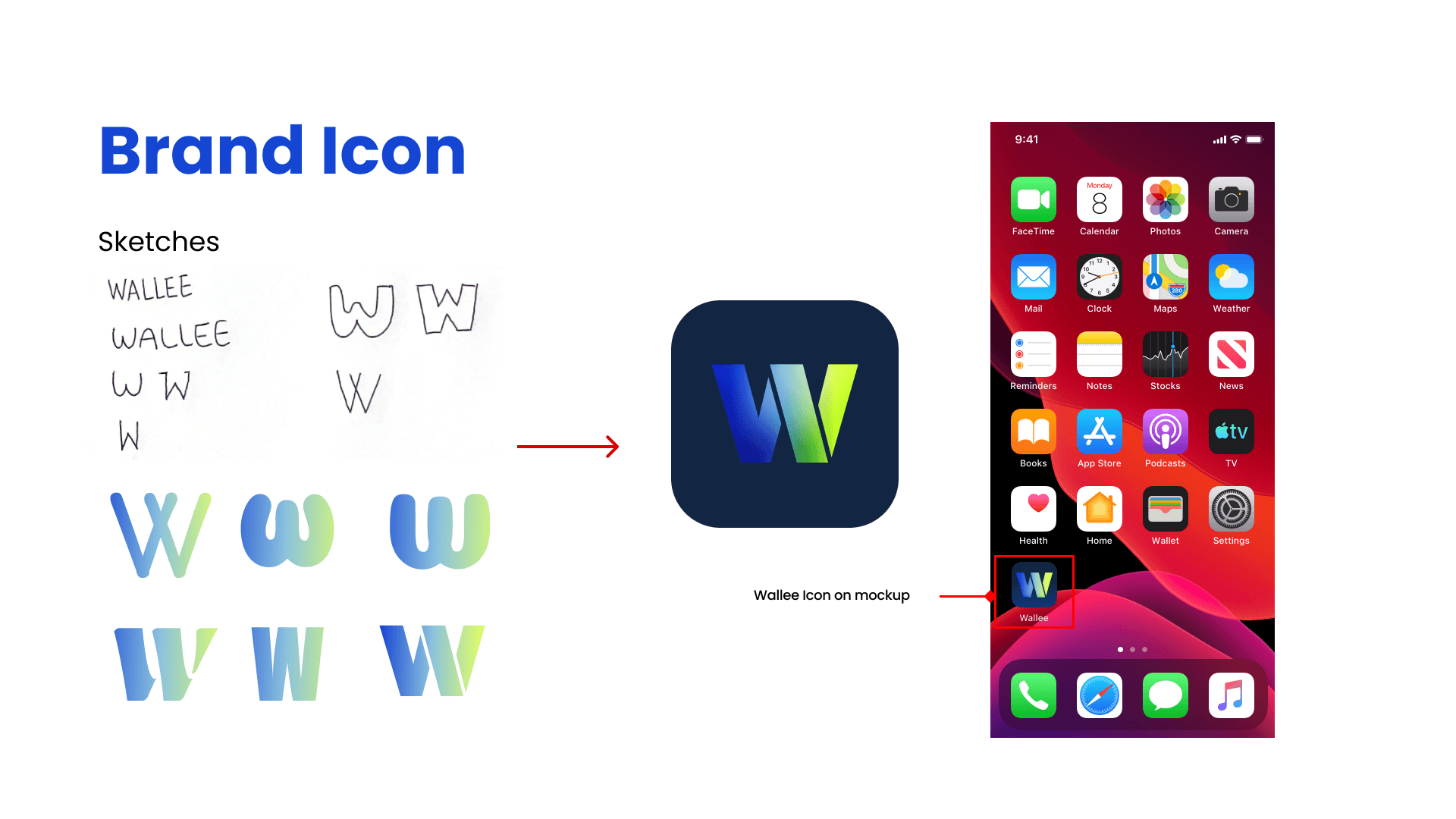

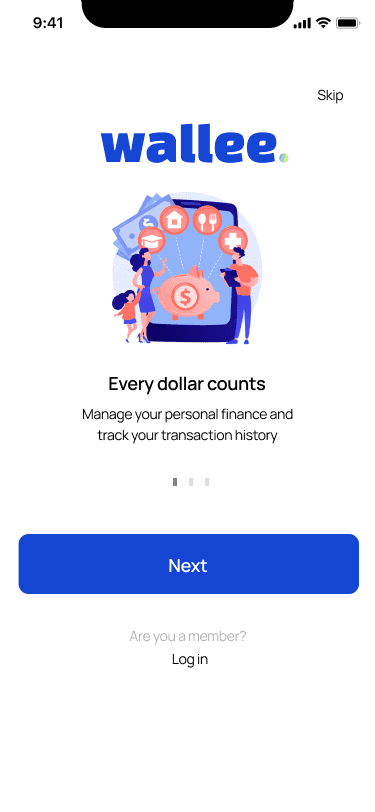

I imagined this app could be a friendly assistant or a robot like ‘Wall-E’ to help users by encouraging them with feedback and providing insights and analytics on users’ financial experience. I focused on delivering a sense of intimateness and caring vibe about the service app.

2. Secondary Research

Market Analysis

Finding more insights from existing data

3. User Interview & Key Insights

Discover

Define

1.Sketches / Crazy 8’s

2. Brand Identity

1.Low-Fidelity

Develop

Design

Deliver

Takeaways

Stating problems to specify users’ painpoints would help me to find out any possible opportunities to build an feasible and efficient service.

In order to gain a more thorough understanding of the users’ pain points and problem context, I focused on the current market circumstances and users’ behaviours.

Observing users’ behaviour and current market status to analyze the problem context

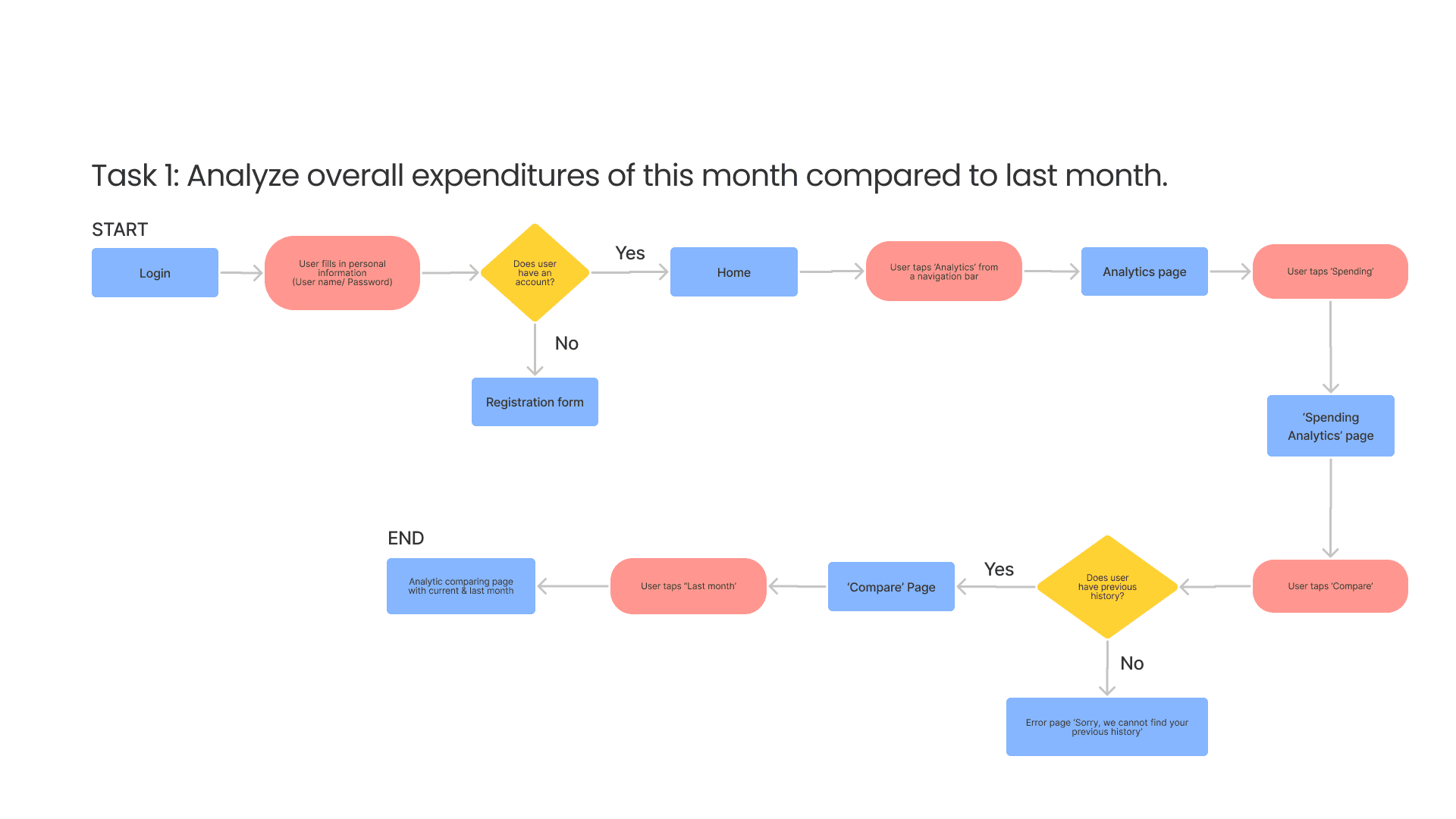

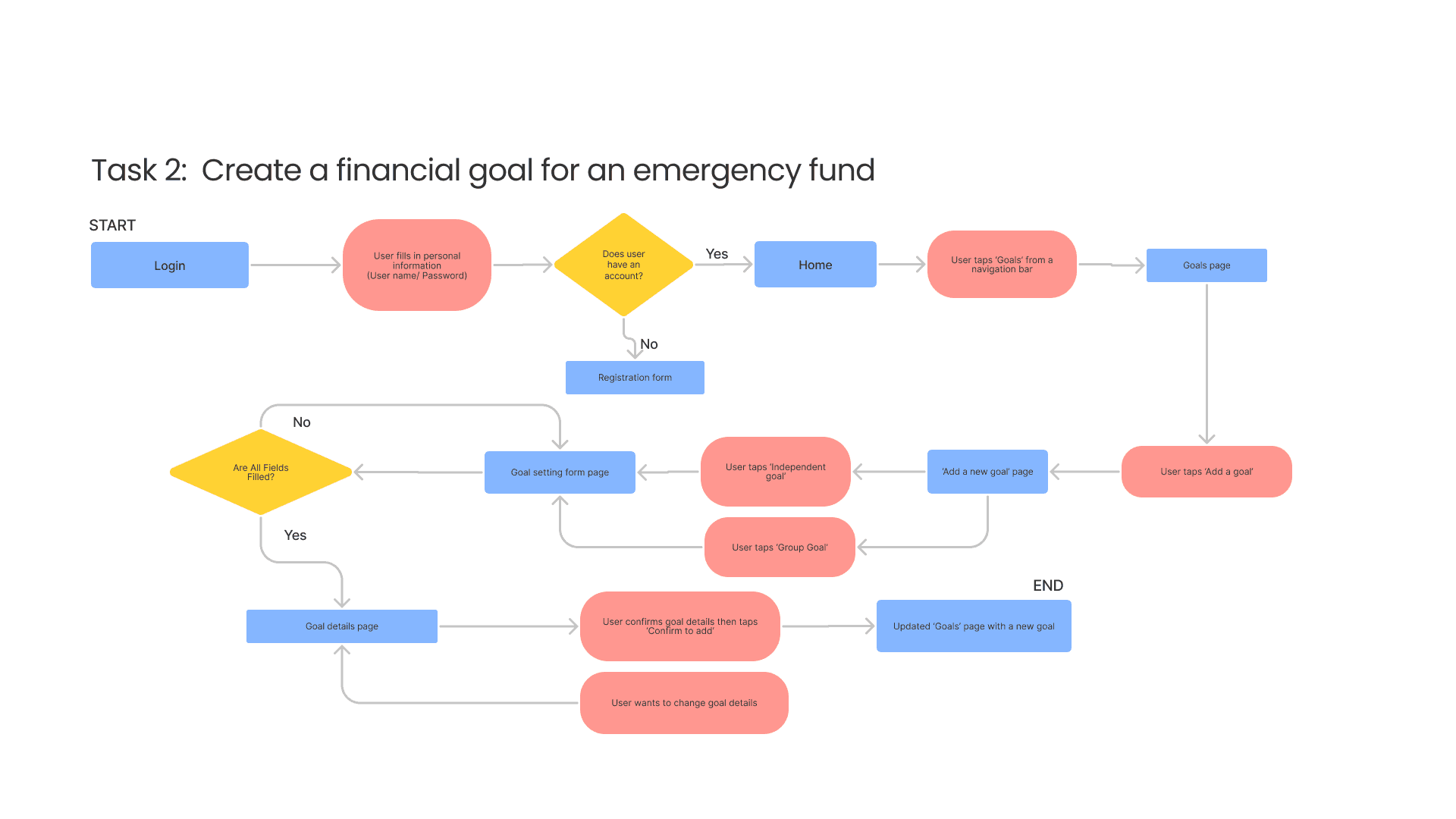

From those insights of research and interviews, I developed a persona, Aya, to highlight key painpoints and goals for deeper understanding users. After creating the persona, I created task flows based on two given senarios to clearly show how users can find proposed solutions from the app.

By doing pages of hand-drawn sketches and prioritizing key features, I deveoped further based on my main task flows

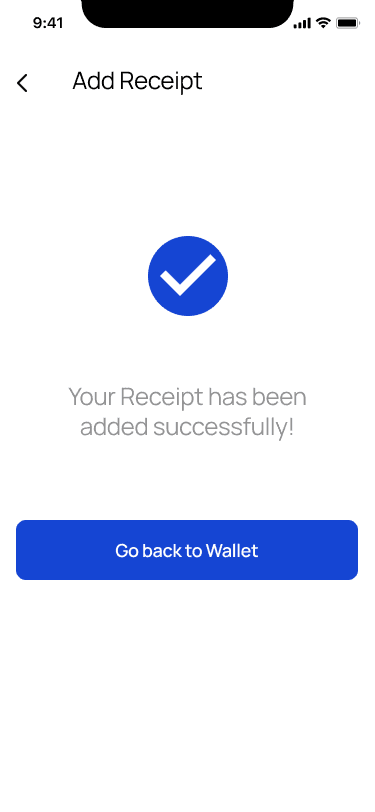

After doing the sketches and creating my brand identity, I started to design the service from low fidelity wireframes to prepare for usability tests.

I have conducted two rounds of usability testing to see how users interact with the prototype and complete given tasks.

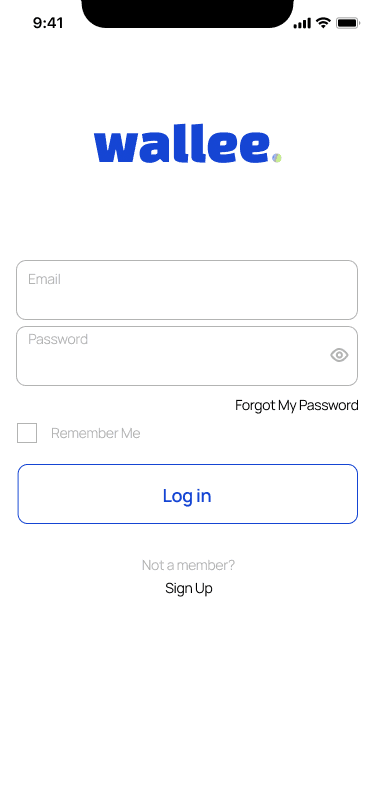

Ease your worries about your hectic spending.

Wallee.

Key Features

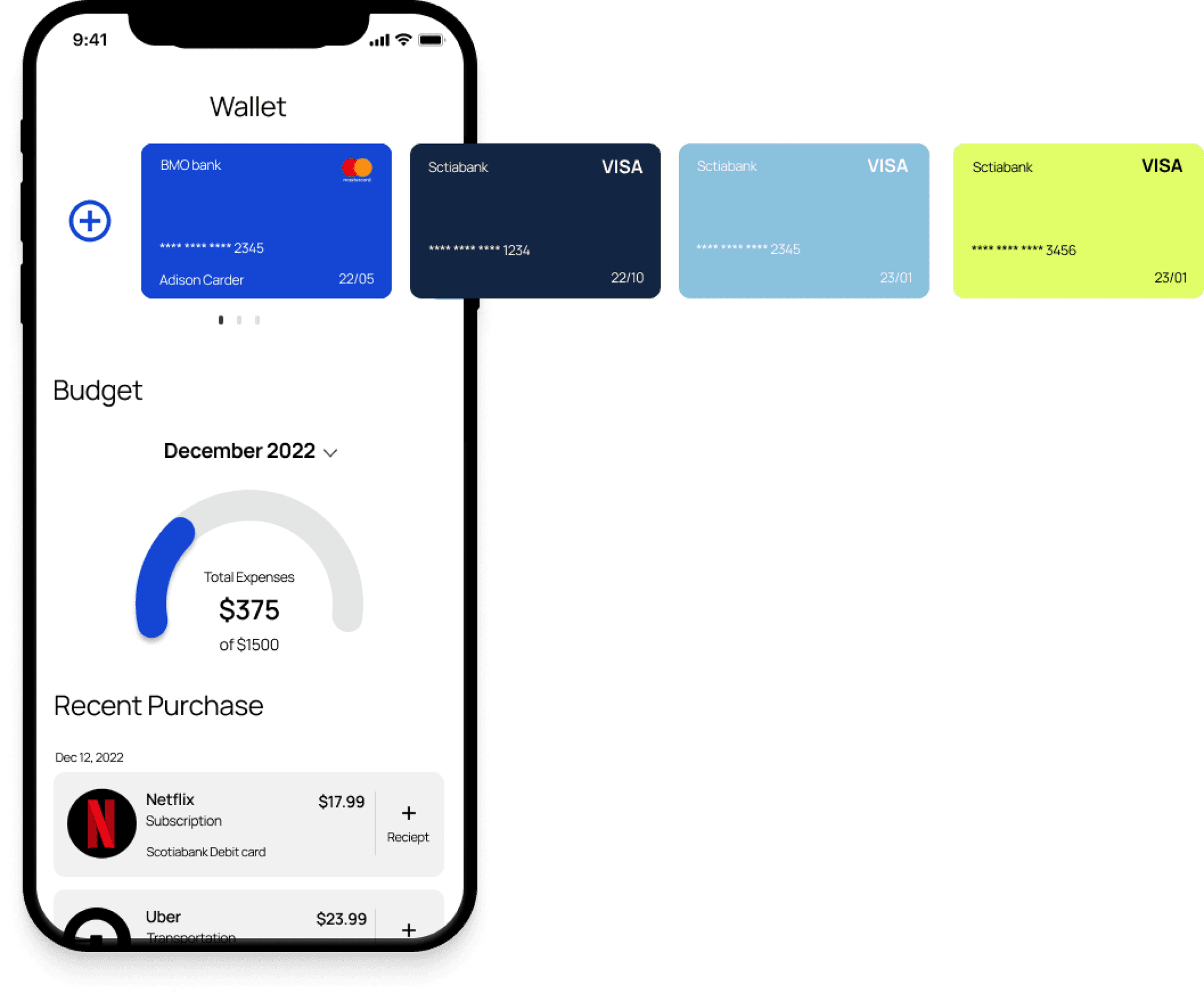

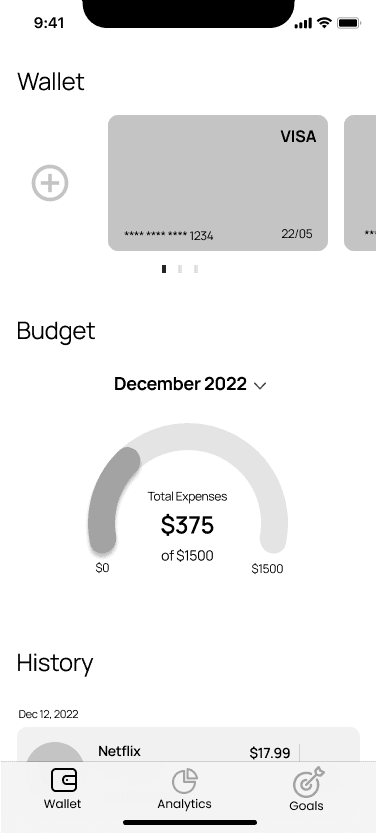

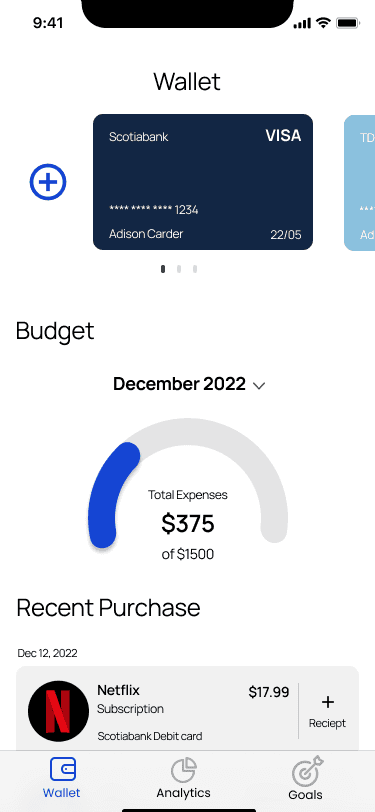

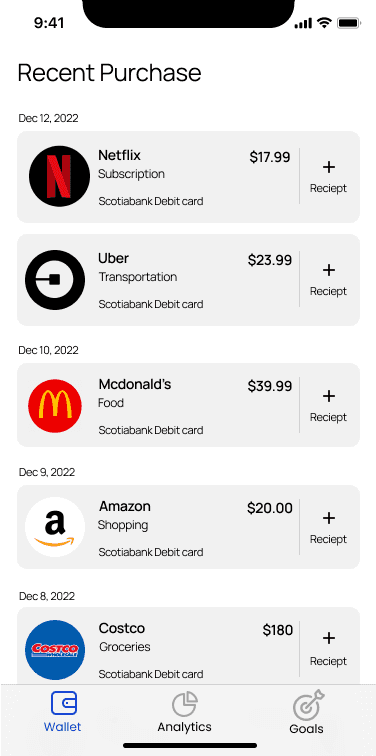

Wallet- Home Page

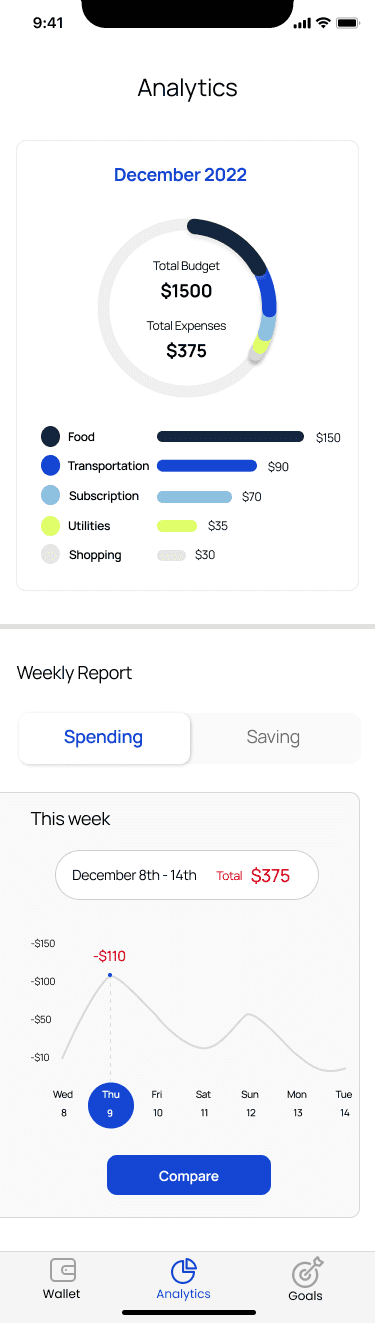

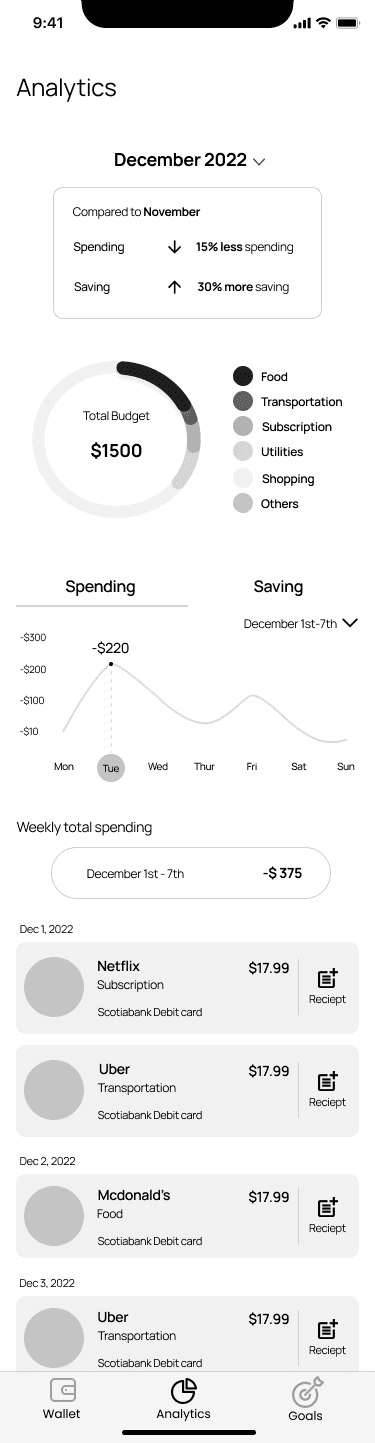

Analytics

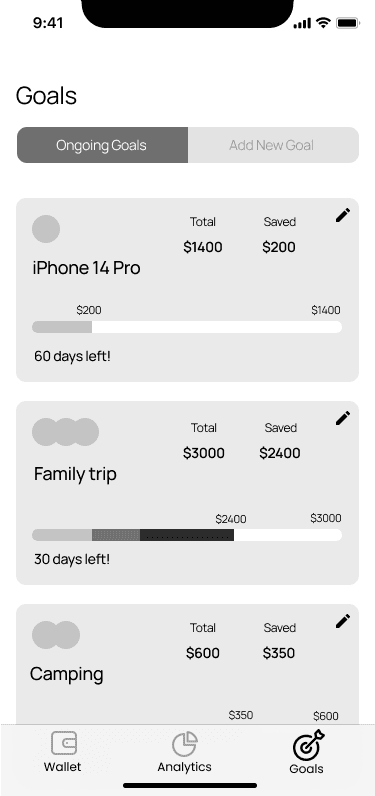

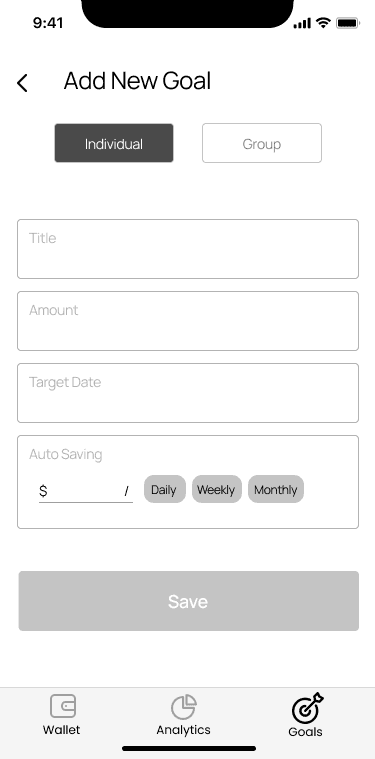

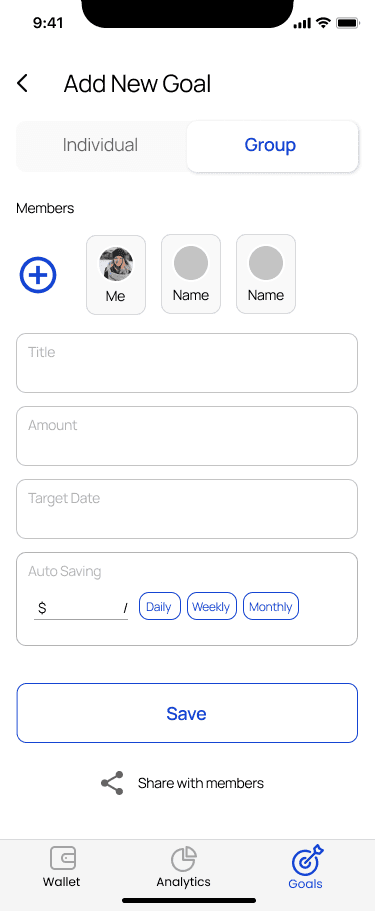

Goals

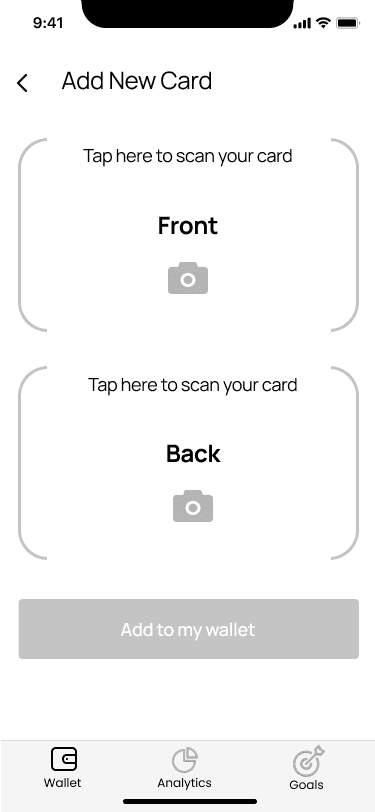

Manage multiple bank accounts & credit cards

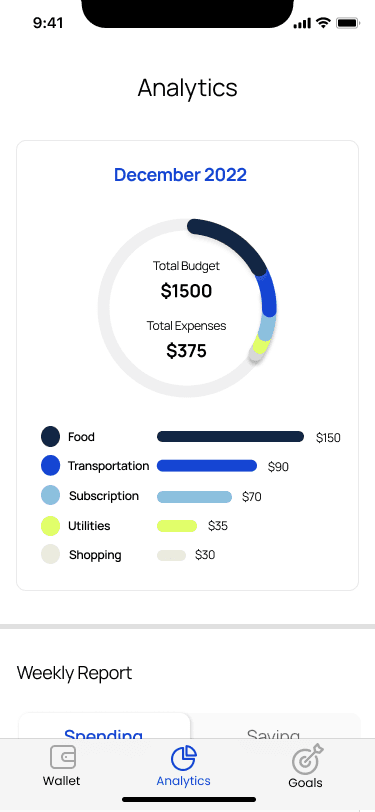

Analyze monthly total expenses with each category

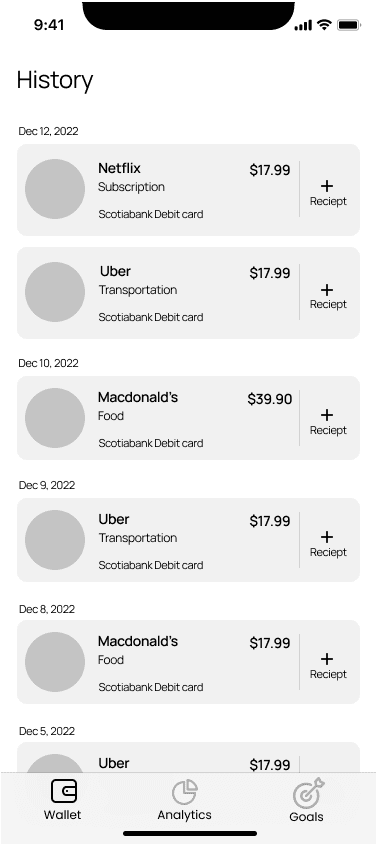

Track all transactions and keep tracking monthly budget

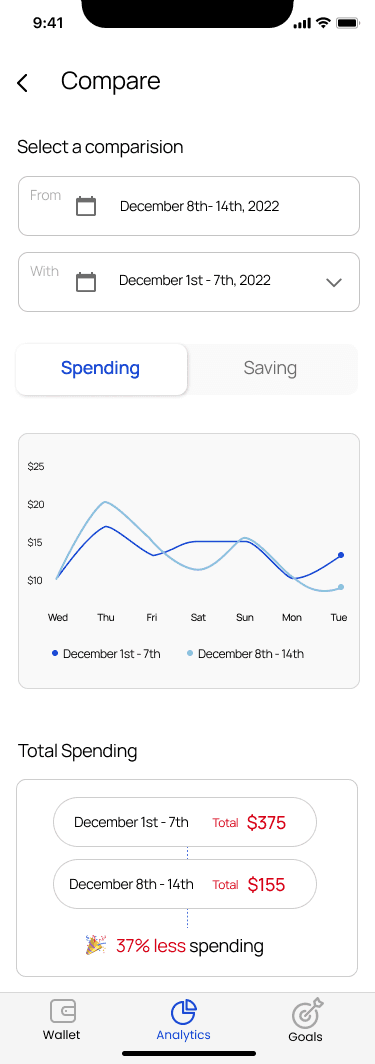

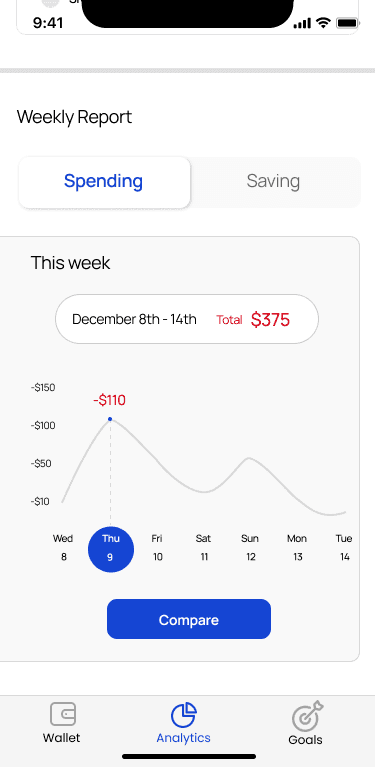

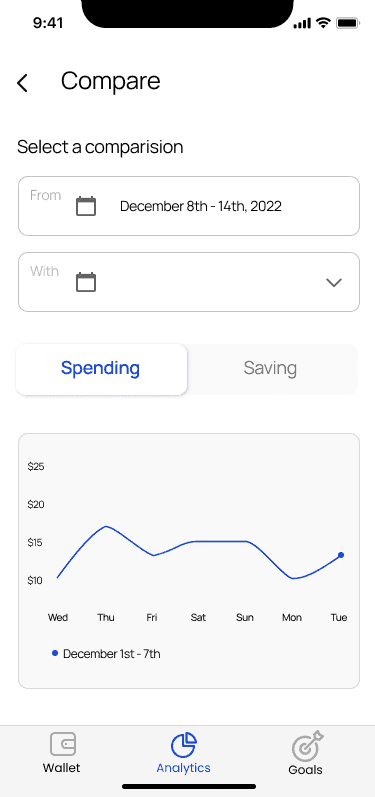

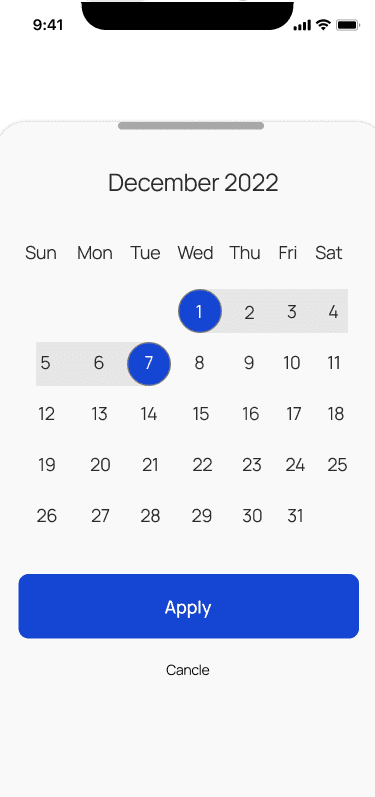

Analyze weekly reports of spending & saving by visual graphs

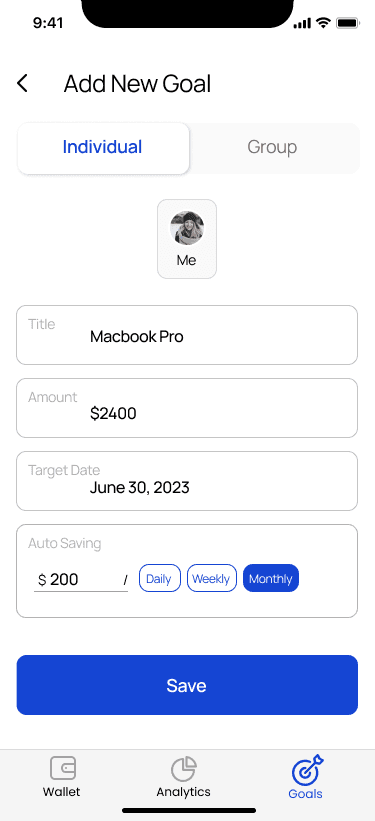

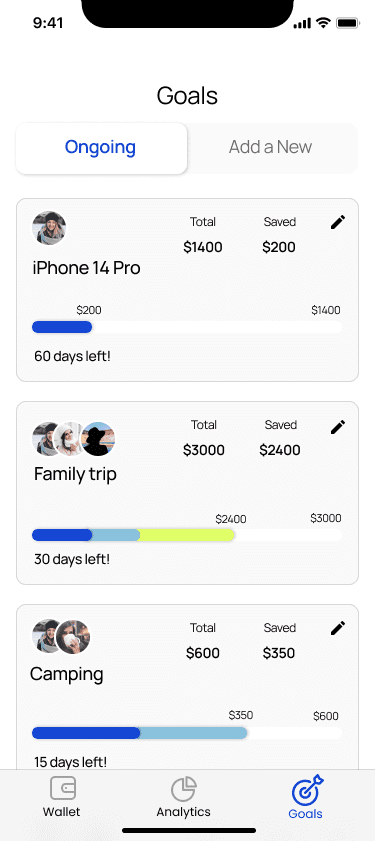

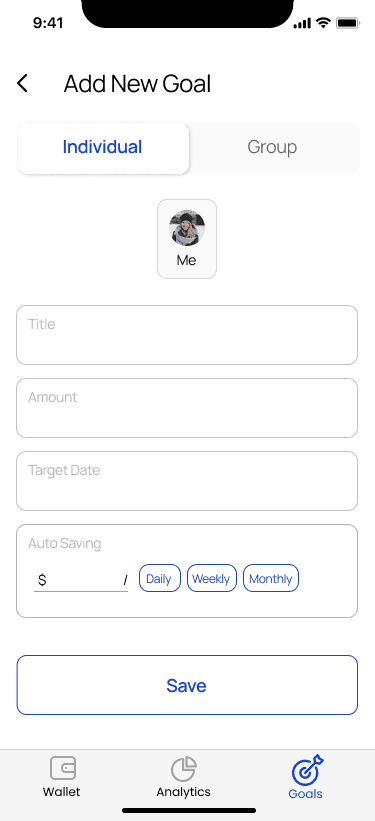

Set up a financial goal for individual & in a group

Keep tracking goals and motivated to save more

Iteration

In order to understand how those main features are understandable and efficient for users, I have conducted two rounds of usability testing.

Key Findings / Opportunities from usability testing:

Providing too much information is not helping users to find the right information. It is important to organize and present them in orders and highlight significant reports.

Need to minimize and focus on the main information. Provide customized options for users to increase users control and freedom to choose and find their own needs

The graph was rather confusing for users. No clear information deliverability.

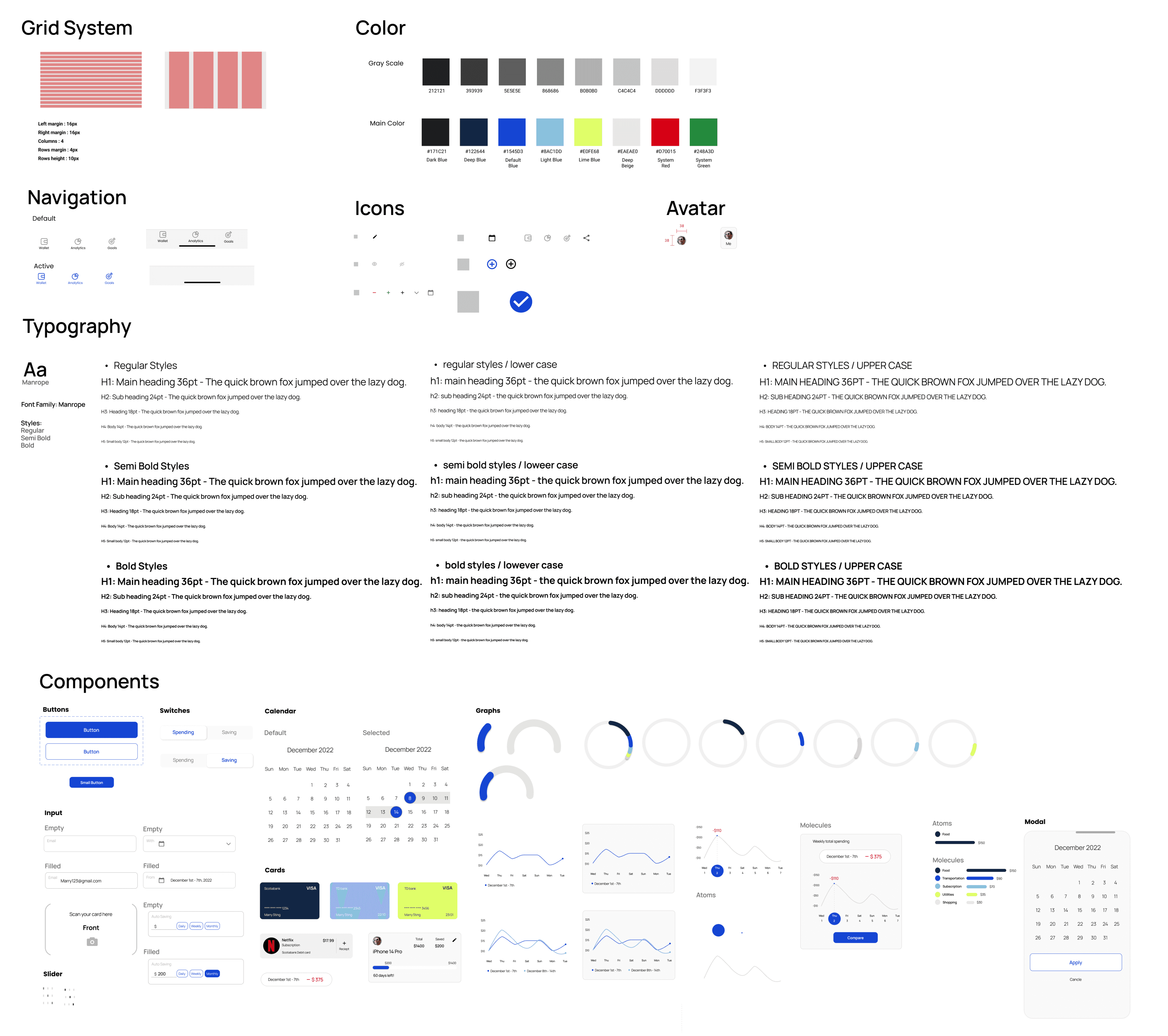

Expand the design system to be prepared for development

Develop further features and adding more details in designs (Card detail and adjustment pages etc.)

Thrid round of userbility testing with Hi-fi prototype - to discover how all design and information are efficiently and clearly itereated

Next Steps

Key takeaways

Never-ending iteration: I have learned that iteration is a key process to innovation.

Importance of user testing: As I was doing more and more testing, I was able to find advanced ideas and solutions throughout deeper understanding of users’ perspectives.

Storytelling & Deliverability: I noticed that having a feasible and realistic storytelling is a key component for improving a clear and relative deliverability and higher understanding for users.

Home page

Analytics page

Goals page

Solution Sketches

2. High Fidelity & Prototype

3. UI Library

Final Iterations

1st Round

2nd Round

Final

How Might We...

help young adults to control their personal budget with insightful plans and be motivated to save money?

Personal Finance Tracking - “I have troubles keeping up to date with all trasactions and if there is a transaction that I’m concerned about, I’am not always sure what to do and where to start finding.“

Analyzing Reuglar Patterns -“I usually found out that the patterns are overlapped and not easily changed. I hope there is something that can visualize my planning by seeing graphs or charts to analyze how I am doing well and how far I have done..“

Planning & Saving Money - “I always struggle to balance between spending and saving. I don’t know how to spend money wisely and meaningfully.“

2 / 3

Living paycheck to paycheck

2/3 of young adults say they are living paycheck to paycheck which means it is significant for them to keep every dollars under their budget

Young adults who are least financial confident and independent are 3 times more likely to have problems on debt.

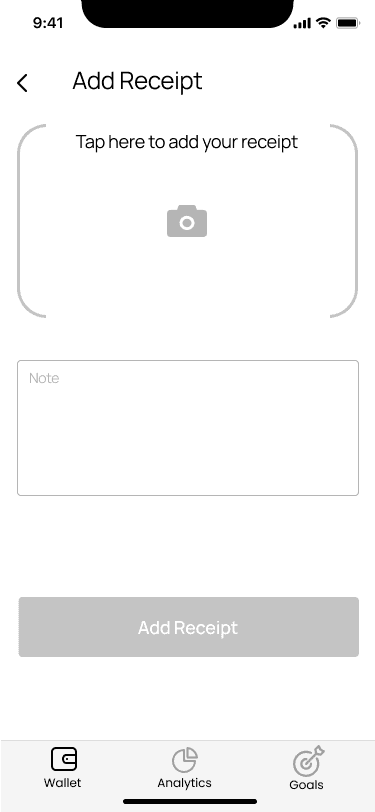

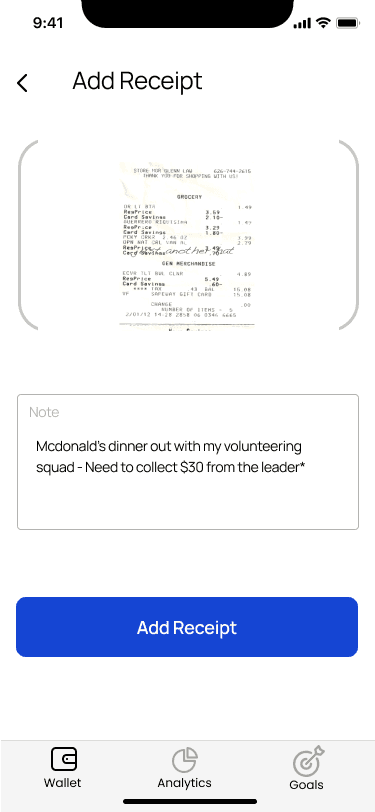

In 2021, the research insured that the number of wasted reciepts are increased, and the amount of wasted receipts are about 686 million pounds annually.

X 3

Likely to have problem debt

686 Million

Pounds

Wasted receipts annually

Easy payment process makes spending money easier

As virtual payment methods are used often these days, it is hard to arouse conscious on controlling our expenditure habits, since spending money becomes easier than ever.

Lack of self-reflection

Young adults who are learning about their expenditure habits and financial patterns, don’t know whether they are doing good or bad, so they would end up having repetitive habits.

Wasted receipts

We still get paper receipts which are usually thrown away and it’s not only wasting paper, but also people forget about details of the transactions.

1

2

3

Difficult environment to set up healthy financial habbits

Iterated

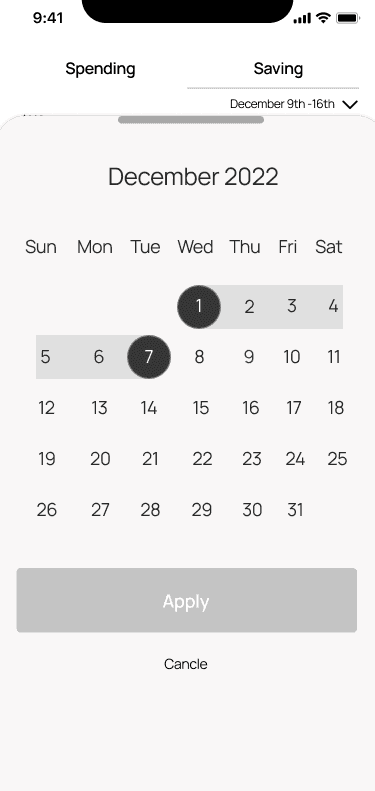

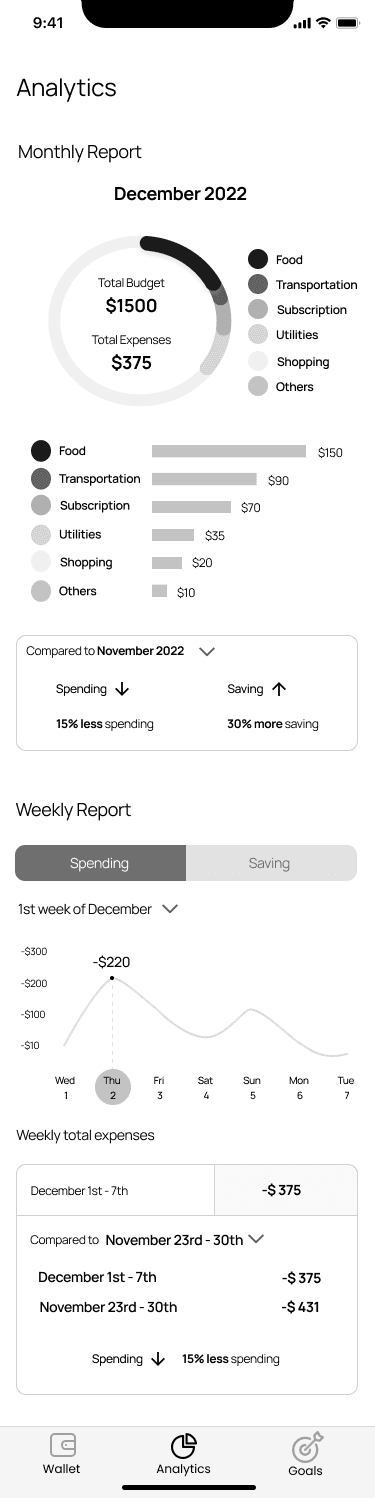

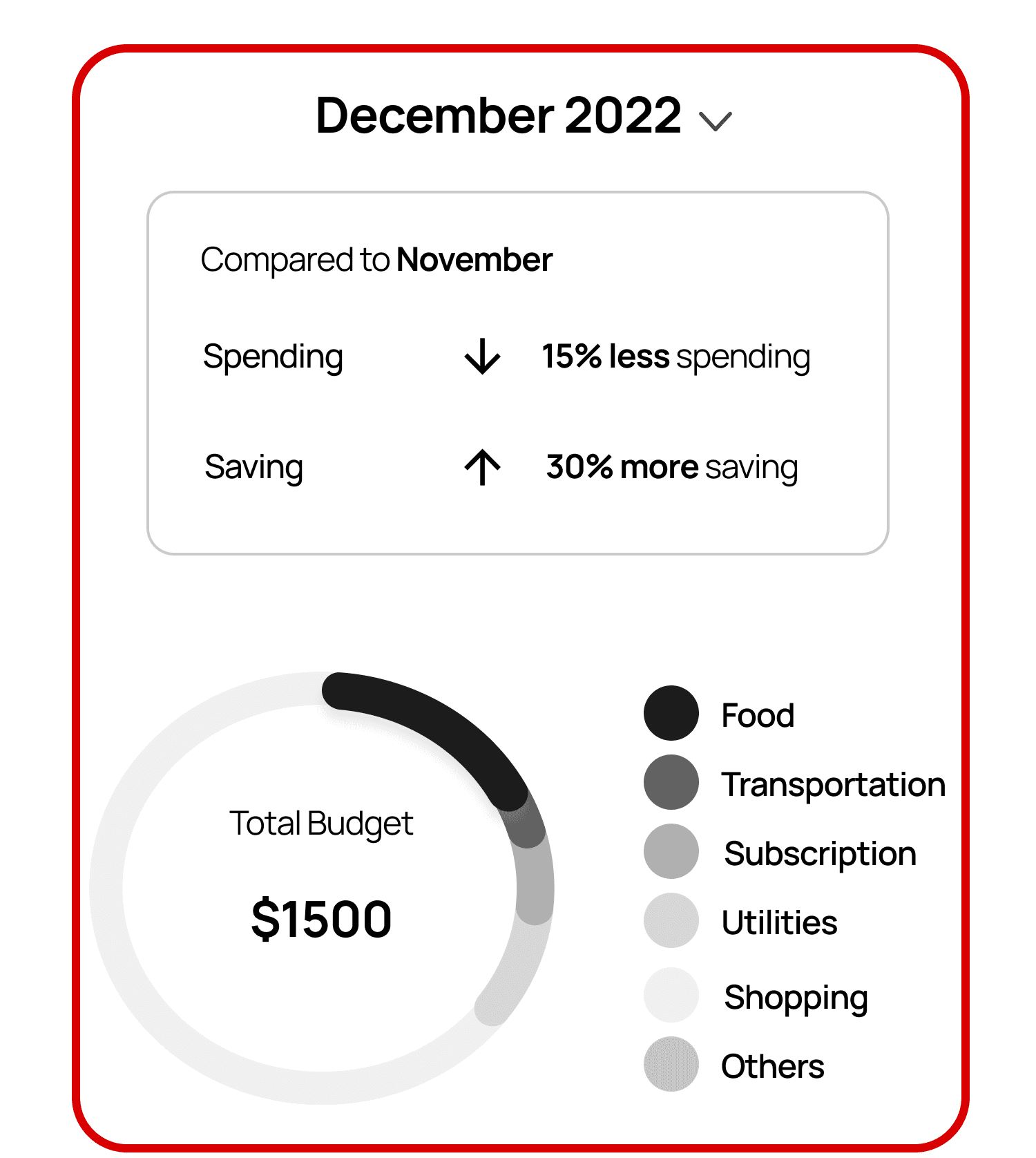

Incorporate ‘Monthly report’ to highlight the focus on monthly spending.

Integrate a bar graph for a visual representation of the totals per category.

Adapt ‘Compared to November’ text to ‘Compared to November 2022’, mirroring ‘December 2022’, for consistency.

Signify the aggregate of all expenses to display the amount users have expended to date.

Embed a dropdown menu next to ‘November 2022’ for allowing users to select their comparison month.

Iterations 1/2

Analytics

December 2022

Food

Transportation

Subscription

Shopping

Utilities

Others

Spending

Saving

Mon

-$10

-$100

-$200

-$300

Tue

Wed

Thur

Fri

Sat

Sun

-$220

December 1st-7th

Total Budget

$1500

Weekly total spending

December 1st - 7th

-$ 375

Dec 2, 2022

Dec 3, 2022

$17.99

Netflix

Subscription

Scotiabank Debit card

Dec 1, 2022

Reciept

$17.99

Uber

Transportation

Scotiabank Debit card

Reciept

Compared to November

Spending

15% less spending

30% more saving

Saving

Wallet

Analytics

Goals

Analytics

December 2022

Food

$150

$70

$35

$20

$10

Transportation

Subscription

Shopping

Utilities

Others

Food

Subscription

Shopping

Utilities

Others

-$10

-$100

-$200

-$300

Wed

Thu

Fri

Sat

Sun

Mon

Tue

1

2

3

4

5

6

7

-$220

1st week of December

Total Budget

Total Expenses

$1500

$375

Weekly total expenses

-$ 375

-$ 375

-$ 431

December 1st - 7th

Compared to November 2022

$90

Transportation

Monthly Report

Weekly Report

Saving

Spending

Spending

15% less spending

Saving

30% more saving

Compared to

November 23rd - 30th

November 23rd - 30th

December 1st - 7th

Spending

15% less spending

Wallet

Analytics

Goals

Iterated

Iterations 2/2

Include a ‘weekly report’ heading to differentiate it from the monthly report.

The ‘spending’ and ‘saving’ sections have been redesigned for clear distinction and ease of identification.

The language has been adjusted from ‘December 1st - 7th’ to ‘1st week of December’.

The section displaying total weekly spending has been expanded to increase visibility and provide detailed insights into the users' weekly expenses.

Problem

2. Task Flow

1.Persona

Keep tracking her monthly budget

Set a financial goal for a special occasion or purchasing pricy items such as a Macbook Pro.

Observe overall transactions

Find expenditure habits or bad financial patterns to advance

Has 4 bank accounts

Frequently uses Apple pay and virtual payment

Has a tight monthly budget and feels anxious about keep every transactions within a set budget

Irregularly save money / No emergency funds

Goals

Bio

Has trouble constantly saving money and loses motivation easily

Overwhelmed with managing multiple bank accounts

Doesn’t know about her expenditure habits

Frustrated about irregular consumption patterns

Age: 24

Location: LA, USA

Occupation: Marketer

Annual Income: $70,000

Aya

Pain Points